nebraska sales tax calculator by address

Free sales tax calculator to lookup the sales tax rate and calculate sales tax by address or zip code in the US. So whilst the Sales Tax Rate in.

Sales Taxes In The United States Wikiwand

This includes the rates on the state county city and special levels.

. The average cumulative sales tax rate in Lincoln Nebraska is 688. When you enter the street address the calculator uses geolocation to pinpoint the exact tax jurisdiction. You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code.

Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. Just enter the five-digit zip. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with.

Lincoln is located within Lancaster County. Restaurants In Matthews Nc That Deliver. From there it can determine the corresponding sales tax rate by accessing.

The Nebraska sales tax rate is currently. The minimum combined 2022 sales tax rate for Page Nebraska is. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt.

Opry Mills Breakfast Restaurants. The Nebraska sales tax rate is currently. 31 rows The state sales tax rate in Nebraska is 5500.

With local taxes the total sales tax rate is between 5500 and 8000. Nebraska sales tax reference for quick access to due dates contact info and other tax details. Sales Tax Rate s c l sr.

Nebraska has recent rate changes Thu Jul 01. Average Sales Tax With Local. Columbus is located within Platte County Nebraska.

Sr Special Sales Tax Rate. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022. There are no local taxes so all of your employees will.

See the County Sales and Use Tax Rates section at the. The Nebraska state sales and use tax rate is 55 055. Nebraska Sales Tax Calculator.

Nebraska Sales Tax Calculator. Click on any county for detailed sales tax rates or see a full list of. As far as sales tax goes the zip code.

In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments. This includes the sales tax rates on the state county city and special levels. S Nebraska State Sales Tax Rate 55 c County Sales Tax Rate.

The state sales tax rate in nebraska is 5500. This is the total of state county and city sales tax rates. The Nebraska NE state sales tax rate is currently 55.

The average cumulative sales tax rate in Fairbury Nebraska is 75. Local Sales and Use Tax Rates Effective July 1 2021 Dakota County and Gage County each impose a tax rate of 05. L Local Sales Tax Rate.

With local taxes the total sales tax rate is between 5500 and 8000. Skip to Attribute Table. Within Columbus there are around 2 zip codes with the most populous zip code being 68601.

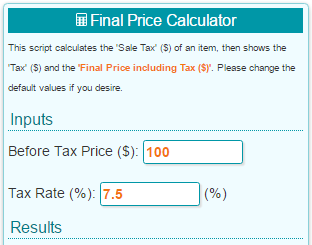

The calculator will show you the total sales tax. The Nebraska state sales and use tax rate is 55 055. Look up rates for short-term rental addresses.

This interactive sales tax map map of Nebraska shows how local sales tax rates vary across Nebraskas 93 counties. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. Nebraska is a destination-based sales tax state.

Sales tax calculator Get free rates. Fairbury is located within Jefferson County. The minimum combined 2022 sales tax rate for Omaha Nebraska is.

This is the total of state county and city sales tax rates. So no matter if you live and run your business in Nebraska or live outside Nebraska but have nexus there you would charge sales tax at the rate. The Nebraska state sales and use tax rate is 55 055.

Skip to Header Controller. The Nebraska state sales and use tax rate is 55.

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Item Price 29 99 Tax Rate 6 25 Sales Tax Calculator

States With Highest And Lowest Sales Tax Rates

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Bitcoin Tax Calculator Easily Calculate Your Tax Obligation Zenledger

6 75 Sales Tax Calculator Template Tax Printables Sales Tax Tax

State Corporate Income Tax Rates And Brackets Tax Foundation

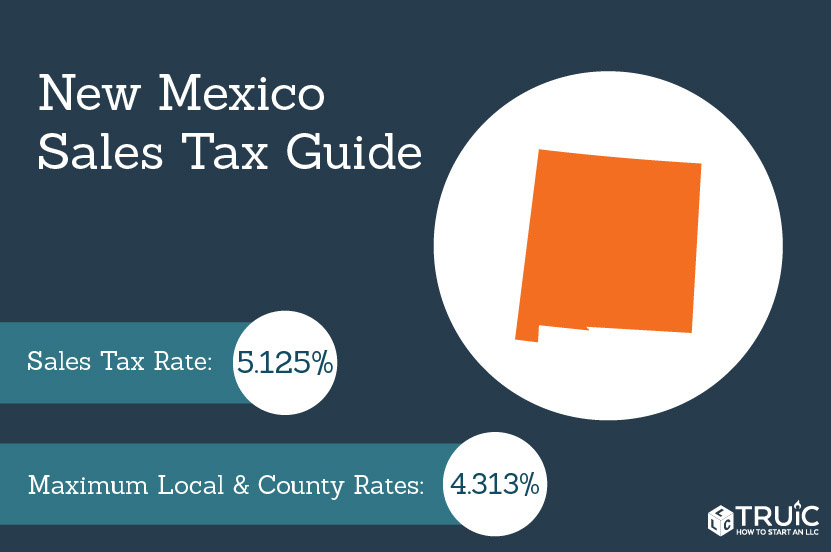

New Mexico Sales Tax Small Business Guide Truic

Income Tax Calculator Estimate Your Refund In Seconds For Free

Car Tax By State Usa Manual Car Sales Tax Calculator

Connecticut Sales Tax Calculator Reverse Sales Dremployee

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

Car Tax By State Usa Manual Car Sales Tax Calculator

State Income Tax Rates Highest Lowest 2021 Changes

How Is Tax Liability Calculated Common Tax Questions Answered